Best ASX Bond ETFs for Conservative Investors (2026)

- Anita Arnold

- Jan 8

- 7 min read

For investors seeking capital preservation and steady income, bond ETFs offer a defensive allocation that can help manage portfolio volatility. This article compares seven ASX-listed bond ETFs across two categories: Australian bonds and international bonds (hedged to AUD).

Quick Comparison Table

Australian Bond ETFs

ETF | Management Fee | Effective Duration | Credit Quality | Yield to Maturity | Holdings |

VAF (Vanguard Australian Fixed Interest) | 0.10% | 4.9 years | AA+ | 4.40% | 828 |

IAF (iShares Core Composite Bond) | 0.10% | 4.92 years | Mix (AAA-BBB) | 4.40% | 709 |

CRED (BetaShares Australian Corporate Bond) | 0.25% | 7.01 years | BBB+ | 6.23% | Portfolio-based |

VGB (Vanguard Australian Government Bond) | 0.10% | 5.4 years | AAA | 4.10% | 166 |

International Bond ETFs (AUD Hedged)

ETF | Management Fee | Effective Duration | Credit Quality | Yield | Holdings |

VIF (Vanguard International Fixed Interest Hedged) | 0.20% | 7.0 years | Government-only | 2.09% | Global treasury |

VBND (Vanguard Global Aggregate Bond Hedged) | 0.20% | Intermediate | BBB- minimum | 2.54% | Global mix |

IHCB (iShares Core Global Corporate Bond Hedged) | 0.25% | Investment-grade | A to BBB | 4.38% | Corporate-focused |

What Is Duration and Why Does It Matter?

Duration measures how sensitive a bond fund is to interest rate changes. A fund with 5 years duration will decrease approximately 5% in value if interest rates rise by 1%, and increase approximately 5% if rates fall by 1%.

Conservative investors should consider:

Lower duration (3-5 years): Less interest rate risk, suitable for shorter time horizons

Medium duration (5-7 years): Balanced approach, moderate interest rate sensitivity

Higher duration (7+ years): Greater interest rate risk, potentially higher yields

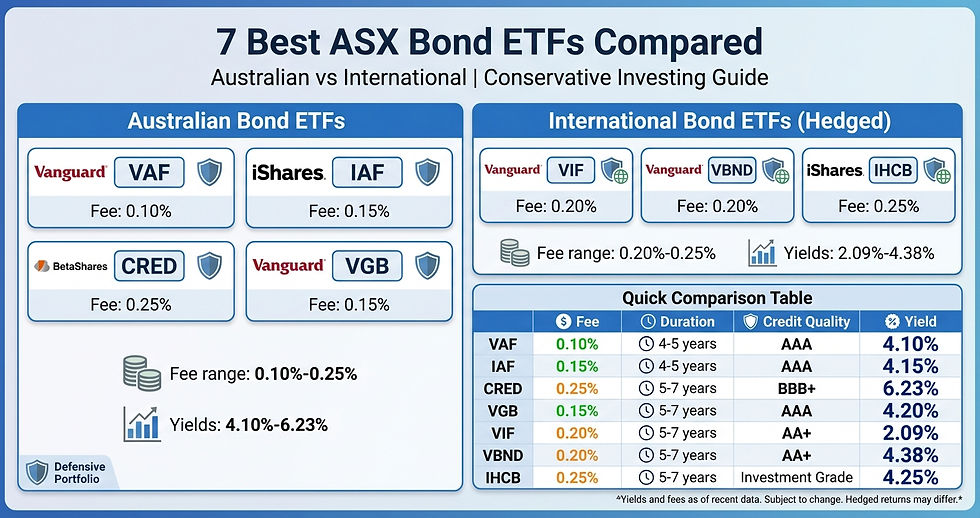

Comparison infographic of 7 ASX bond ETFs showing VAF, IAF, CRED, VGB, VIF, VBND, IHCB with management fees, duration, credit quality ratings, and yield to maturity for conservative Australian investors

Australian Bond ETFs: The Core Options

VAF: Vanguard Australian Fixed Interest Index ETF

Overview: VAF tracks the Bloomberg AusBond Composite 0+ Year Index, providing broad exposure to Australian bonds including government, semi-government, and corporate issuers.

Key Characteristics:

Fee: 0.10% p.a.

Duration: 4.9 years (moderate interest rate sensitivity)

Credit Quality: AA+ (high quality)

Yield to Maturity: 4.40%

Holdings: 828 securities across 231 issuers

Top Holdings: Australian Commonwealth Government (46.9%), NSW Treasury Corporation (9.7%)

Composition:

Treasury: 46.9%

Government-Related: 44.4%

Corporate: 8.4%

Securitised: 0.4%

Who It Suits: Investors seeking low-cost, diversified exposure to the entire Australian bond market with high credit quality. VAF's balanced mix of government and corporate bonds provides defensive characteristics while maintaining yield.

IAF: iShares Core Composite Bond ETF

Overview: IAF aims to track the Bloomberg AusBond Composite 0+ Year Index, similar to VAF, offering comprehensive Australian bond market exposure.

Key Characteristics:

Fee: 0.10% p.a.

Duration: 4.92 years (moderate interest rate sensitivity)

Yield to Maturity: 4.40%

Holdings: 709 securities

Distribution: Quarterly

Top Holdings: Australian Commonwealth Government (46.81%), state treasury corporations

Credit Allocation:

AAA: Majority allocation

AA to BBB: Investment-grade spread

Who It Suits: Investors wanting similar exposure to VAF with BlackRock's indexing approach. The near-identical fees and characteristics make either fund a strong core holding.

CRED: BetaShares Australian Investment Grade Corporate Bond ETF

Overview: CRED focuses exclusively on Australian corporate bonds, providing higher yields than government-heavy portfolios through exposure to investment-grade corporate issuers.

Key Characteristics:

Fee: 0.25% p.a.

Average Maturity: 7.01 years (higher than VAF/IAF)

Credit Quality: BBB+ average (investment-grade)

Yield to Maturity: 6.23% (significantly higher than government bonds)

Distribution: Monthly (vs quarterly for most bond ETFs)

Risk Considerations:

Higher corporate exposure means greater credit risk

Longer duration (7 years) increases interest rate sensitivity

BBB+ rating indicates lower-rated investment-grade bonds

Who It Suits: Investors comfortable with moderate credit risk in exchange for higher yields. The monthly distributions appeal to income-focused retirees, but the longer duration and corporate focus require higher risk tolerance than government bond funds.

VGB: Vanguard Australian Government Bond Index ETF

Overview: VGB invests exclusively in Australian government bonds, providing the highest credit quality and capital stability among Australian bond ETFs.

Key Characteristics:

Fee: 0.10% p.a.

Duration: 5.4 years

Credit Quality: AAA (highest rating)

Yield to Maturity: 4.10%

Holdings: 166 government securities across 11 issuers

Credit Allocation:

AAA: 73.3%

AA: 26.7%

Who It Suits: Highly conservative investors prioritising capital preservation over yield. VGB's government-only focus eliminates corporate credit risk, making it the safest option for defensive portfolios. The trade-off is a lower yield (4.10%) compared to composite bond funds.

International Bond ETFs (AUD Hedged): Global Diversification

VIF: Vanguard International Fixed Interest Index (Hedged) ETF

Overview: VIF tracks the Bloomberg Global Treasury Scaled Index (hedged to AUD), providing exposure to government bonds from developed markets globally, with currency risk hedged back to Australian dollars.

Key Characteristics:

Fee: 0.20% p.a.

Duration: 7.0 years (higher than Australian bond ETFs)

Yield: 2.09% (lower than Australian bonds)

Holdings: Government treasury bonds from developed nations

Geographic Mix: US (34.4%), Japan (24%), other developed markets

Why It's Hedged: Currency hedging removes the impact of AUD/foreign currency movements, focusing returns purely on bond performance. Without hedging, currency fluctuations could significantly impact returns.

Who It Suits: Investors seeking geographic diversification beyond Australia while maintaining defensive characteristics. The lower yield reflects the global government bond market's current rates, which are generally lower than Australia's. The 7-year duration makes it more sensitive to interest rate changes.

VBND: Vanguard Global Aggregate Bond Index (Hedged) ETF

Overview: VBND tracks the Bloomberg Barclays Global Aggregate Float-Adjusted Bond Index (hedged to AUD), providing diversified exposure to both government and corporate bonds globally.

Key Characteristics:

Fee: 0.20% p.a.

Yield: 2.54%

Credit Quality: Minimum BBB- (investment-grade)

Holdings: Government, government-related, corporate, and securitised bonds globally

Mix Advantage: Unlike VIF's government-only approach, VBND includes corporate bonds, offering slightly higher yields (2.54% vs 2.09%) with marginally higher credit risk.

Who It Suits: Investors wanting broad global bond exposure with both government and corporate issuers. VBND functions as an international complement to Australian-focused portfolios, adding geographic diversification while maintaining investment-grade quality.

IHCB: iShares Core Global Corporate Bond (AUD Hedged) ETF

Overview: IHCB focuses exclusively on global investment-grade corporate bonds, providing the highest yield among international bond ETFs through corporate credit exposure.

Key Characteristics:

Fee: 0.25% p.a.

Yield: 4.38% (highest among international options)

Credit Quality: Investment-grade (A to BBB ratings)

Holdings: Corporate bonds from developed and emerging markets

Corporate Focus: The exclusive corporate bond exposure explains the higher yield compared to government-heavy funds. Investors accept corporate credit risk in exchange for enhanced income.

Who It Suits: Investors seeking international corporate bond exposure with higher yields than government bonds. The 4.38% yield is competitive with Australian bond ETFs while providing global diversification. However, corporate-only exposure means greater credit risk during economic downturns.

How to Choose the Right Bond ETF

For Maximum Safety: VGB

Investors prioritising capital preservation above all else should consider VGB's government-only portfolio with AAA credit quality. Accept the lower 4.10% yield as the premium for maximum safety.

For Balanced Core Holdings: VAF or IAF

Most investors find VAF or IAF ideal for core bond allocations. Both offer 0.10% fees, moderate 4.9-year duration, high credit quality (AA+), and 4.40% yields. The balanced mix of government and corporate bonds provides defensive characteristics with reasonable income.

For Higher Income: CRED or IHCB

Income-focused investors comfortable with corporate credit risk may prefer CRED (Australian corporate, 6.23% YTM) or IHCB (global corporate, 4.38% yield). Both offer monthly/quarterly distributions but require accepting longer duration and corporate credit exposure.

For Global Diversification: VBND

Investors wanting to complement Australian holdings with international exposure should consider VBND's global government and corporate mix. The 2.54% yield is lower than domestic options, reflecting global bond markets, but provides valuable geographic diversification.

Portfolio Construction Examples

Conservative Retiree (60% bonds, 40% equities)

30% VAF (core Australian bonds)

15% VGB (maximum safety government bonds)

15% VBND (international diversification)

40% diversified equity ETFs

Moderate Income Seeker (40% bonds, 60% equities)

20% IAF (core Australian bonds)

10% CRED (higher income corporate bonds)

10% IHCB (international corporate bonds)

60% diversified equity ETFs

Highly Conservative (80% bonds, 20% equities)

40% VGB (maximum safety)

30% VAF (balanced core)

10% VBND (international diversification)

20% diversified equity ETFs

Fee Impact Over 20 Years

On a $100,000 investment returning 4% annually before fees:

ETF | Fee | 20-Year Balance | Fee Cost |

VAF, IAF, VGB | 0.10% | $216,900 | $2,110 |

VIF, VBND | 0.20% | $214,800 | $4,210 |

CRED, IHCB | 0.25% | $213,700 | $5,310 |

The 0.15% difference between cheapest (0.10%) and most expensive (0.25%) options costs $3,200 over 20 years on a $100,000 investment.

Key Considerations for Bond Investors

Interest Rate Risk: Bond prices fall when interest rates rise. Longer duration funds (7+ years) experience greater price volatility. Conservative investors should consider duration alongside yield.

Credit Risk: Corporate bonds offer higher yields but carry default risk. Government bonds (VGB, VIF) eliminate credit risk but provide lower yields.

Diversification: Combining Australian bonds (VAF, IAF) with international bonds (VBND, VIF) provides geographic diversification, reducing concentration in Australian interest rates and credit markets.

Distribution Frequency: Most bond ETFs pay quarterly (VAF, IAF, VBND), but CRED offers monthly distributions, which may suit retirees needing regular income.

Currency Hedging: All international ETFs listed (VIF, VBND, IHCB) hedge currency exposure back to AUD. This eliminates currency risk, ensuring returns depend solely on bond performance rather than exchange rate movements.

Final Thoughts

Bond ETFs serve as defensive portfolio anchors, providing income and capital stability. For most conservative investors, VAF or IAF form an excellent core holding at 0.10% fees with balanced exposure. Those seeking maximum safety should consider VGB's government-only approach, while income seekers may add CRED or IHCB for higher yields through corporate exposure.

International bond ETFs (VIF, VBND, IHCB) offer geographic diversification but currently yield less than Australian bonds, reflecting global interest rate settings. Consider combining domestic and international bond exposure for a well-diversified fixed-income allocation.

Remember: bonds reduce portfolio volatility but will still fluctuate with interest rate changes. Investors should match duration and credit quality to their risk tolerance and time horizon. Disclaimer: Finer Market Points Pty Ltd, CAR 1304002, AFSL 526688, ABN 87 645 284 680. This general information is educational only and not financial advice, recommendation, forecast or solicitation. Consider your objectives, financial situation and needs before acting. Seek appropriate professional advice. We accept no liability for any loss or damages arising from use.

Comments